The market has changed a lot since the beginning of 2022. We are in familiar territory. Many people will say they have reached a "normal" market; however, Tucker Company Worldwide's CEO, Jeff Tucker, believes that there is no such thing as a "normal" moment in this market. Momentarily we are balanced.

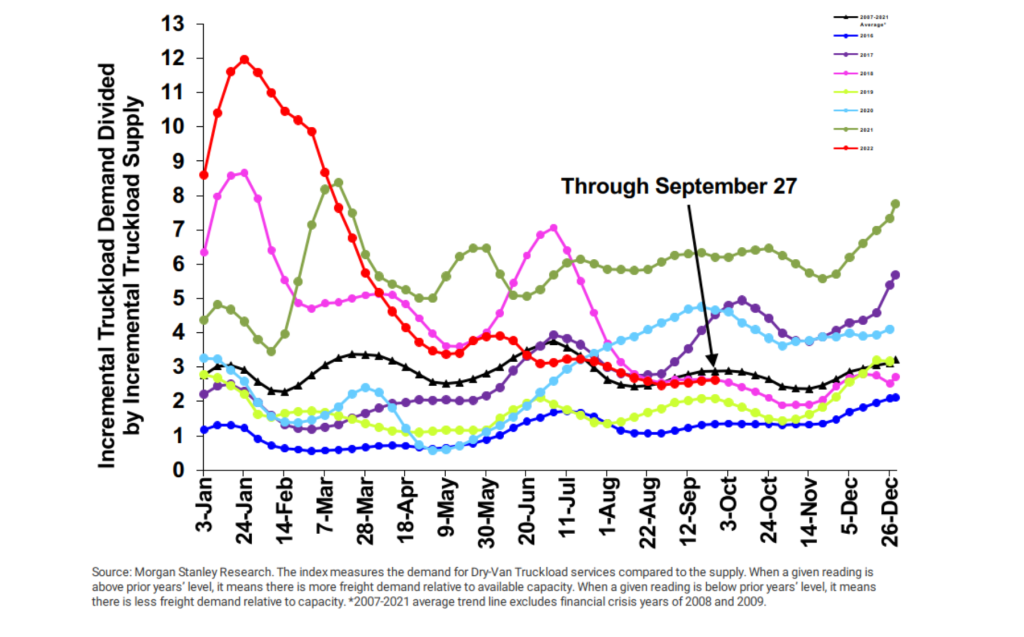

Figure 1. Morgan Stanley Dry Van ONLY Truckload Freight Index

As shown in Figure 1, 2022's demand for truckload driving came in like a lion, as indicated by the red line above. Most of this demand correlates closely with the demand seen in the spot market. The spot market will amplify this overall demand. The average demand from 2007 to 2021, represented by a black line, indicates a delicately balanced equilibrium between supply and demand. As of 2022, we are just slightly below that equilibrium.

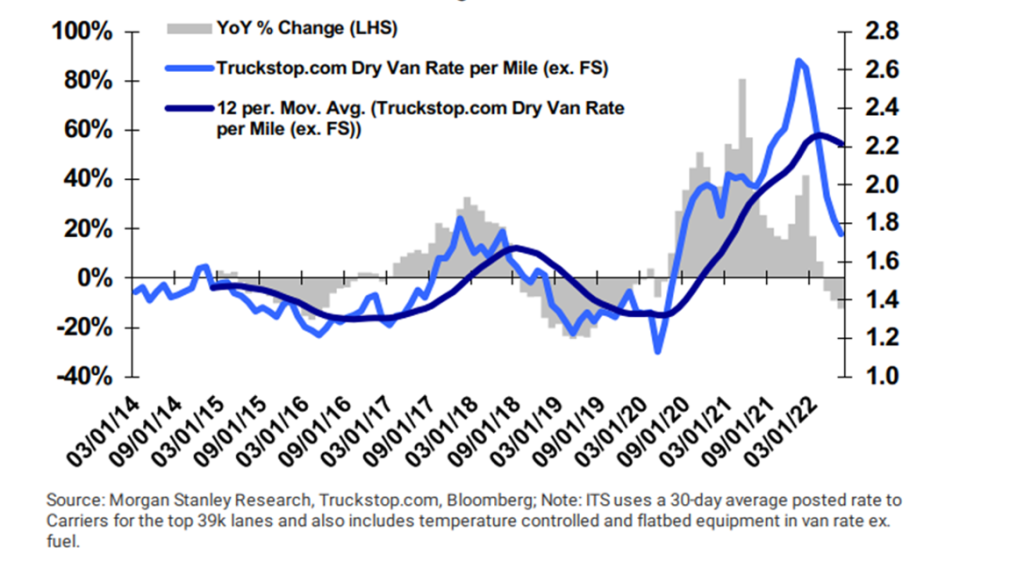

Figure 2. Morgan Stanley Van Rate ex. Field Long-Term Trends

Presented in Figure 2 above is our new normal. If one can figure this out, one can gain a strategic advantage in the field of competitors. This new "normal" means that every 2 to 3 years, we experience a capacity crisis because we have been delicately balanced. Before Covid, a 2.5% GDP (Good Distribution Practices) for a quarter would push us into the area of a capacity crisis.

As Americans, our corporate culture regarding procuring transportation strategy is flawed. It causes capacity crises. A couple of things happen immediately when a spot market softens.

Immediately the largest shippers' real freight costs decrease significantly – without any bids or new rates. Often, they do not recognize it. Jeff Tucker explained, "What happens is that in a loose market, it goes right into the spot market, and you pay spot prices." This procurement strategy causes capacity crises.

Where are things right now? "We are seeing huge savings that, as a national buying and procurement thought process, we do not fully understand, but it's happening," Jeff stated. Good stuff, right? What comes next sets us up to repeat our past mistakes.

"Bid Season" is coming up anywhere from now until February. As buyers and sellers of transportation, this is when buyers look to cut their freight costs deeply. Buyers gravitate toward the largest carriers. Because spot rates are down, the theory goes that contract rates should go down too. That is true, but as brokers living in the margin, Tucker knows that spot rates and contract rates are two different marketplaces entirely. These strategies are flawed as they ignore the realities of the marketplace.

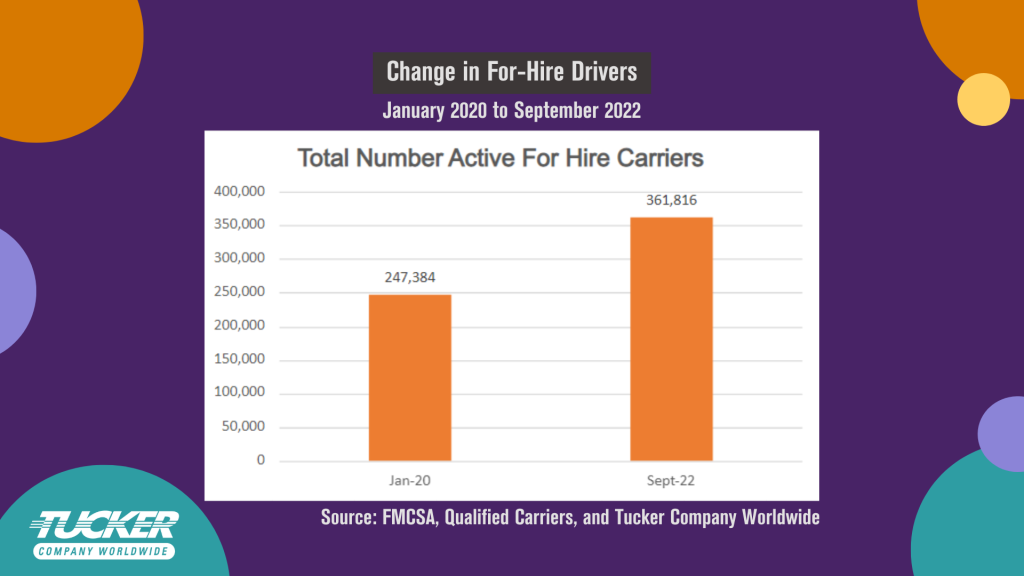

Figure 3. Change in Total Number of Active For-Hire Drivers

In the 2 ½ years, from January 2020 to September 2022, the number of active For-Hire Carriers has increased by 114,432 (46%) to 361,816 as of last month. 99.7% of that total was in fleets of 1-100 trucks. The average size of 1-100 truck fleets is 5.3 trucks. You hear a lot of big carrier mergers happening because they cannot grow their fleets to meet the demand from the largest shippers, so the only way they can do it is by merging. 54% (more than half of all drivers in the U.S. that drive semis) drive for these 1-100 truck fleets. Roughly 1 million more drivers drive in this segment than 10 years ago, on a base of 3.5 M drivers; this is extraordinary growth. Jeff Tucker noted, "You must understand that if you are trying to influence purchasing procurement behavior for the positive if you are trying to build a reliant, flexible, and fungible supply chain where you are not paying at these peaks, you must understand this. Otherwise, you are going in the wrong direction."

To avoid this, one must seek a balanced approach, using the marketplace to their long-term strategic advantage.

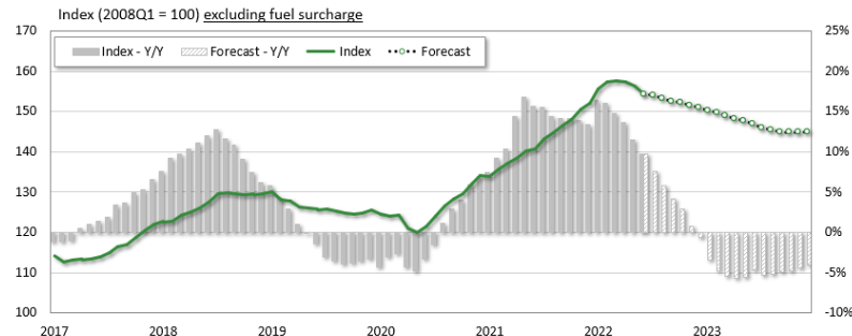

Figure 4. FTR Total Truckload rates -- Contract

Source: FTR Freight-cast TM; FTR trucking Update Service

As displayed in Figure 4, FTR predicts contract rates for 2023 in the future would be a 4.8% year-on-year decline after a gain of 8% this year. This is not a substantial precipitous drop you would see in the spot market, but as stated before, contract and spot rates are two different animals tied together by a common theme.

The best way to win every season is equally allocating freight to providers. To do this, here are Jeff's golden rules:

You are far better off if you understand where the data is and where the markets are.

Save the date for Tucker Company Worldwide’s next market update webinar on Thursday, December 15th, at 1 p.m. ET. We encourage you to register today. We look forward to seeing you there!