Small fleets (1-6 trucks) are the backbone of trucking. They keep the market balanced, competitive and nimble and they represent the majority of the spot market volume. Many small fleets exist without shipper customers—simply using load boards to find the next load.

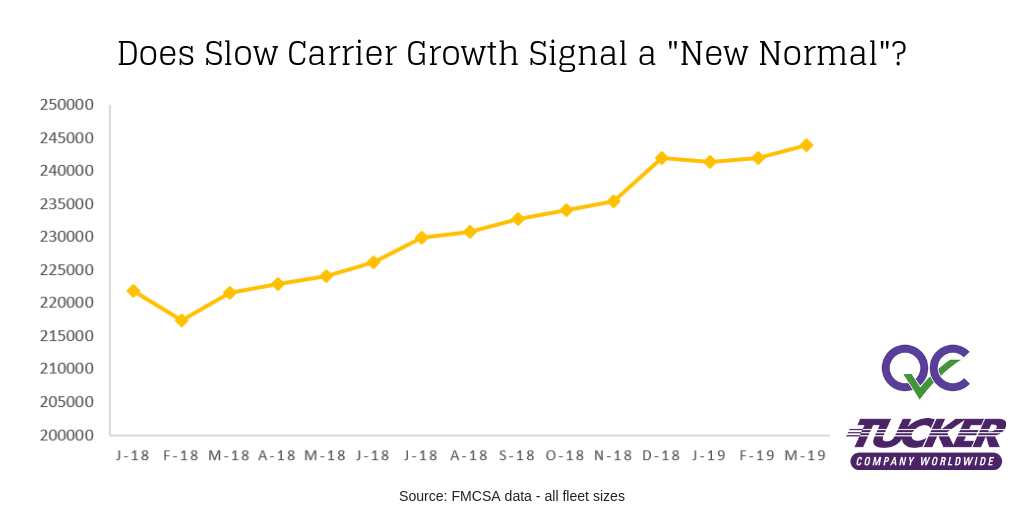

January represented either a blip or the beginning of tougher times. The nation lost 684 carriers from 1-6 trucks, from a fleet size of 201,539 in December. A small, but meaningful decline. It represented the first decline in 11 months, but the 17th monthly decline since March 2011. Considering the spot market has softened in the past few months, it has us wondering if we’re seeing a balance or a trend reversal.

Before we get too far ahead of ourselves, despite a drop, January’s numbers were the second largest number of active for-hire motor carriers ever recorded, 241,422.

Focusing again on the fleets with 1-6 trucks, January represented the second largest number of active for-hire carriers ever recorded, with fleet sizes 1-6, even after a big January loss of 684 carriers. February saw a rebound of 294 carriers.

Looking at the driver data for that segment is interesting too. Since 2012, fleets with 1-100 trucks added far more drivers than the largest (501+) truck fleets. In fact, fleets from 1-100 trucks added more than double the number of drivers than the biggest carriers, despite the pay raises and bonuses.

Most of that growth came from the 1-6 truck fleets. January’s data marked a significant decline in the number of drivers for the 1-6 truck fleets, falling by 5,457. February followed with a much smaller 187 decline in drivers for that segment. While small 187 is a small decline, it’s only the first time since 2012, there has been a decline over two consecutive months. Overall, across fleet sizes of 7-19, 20-100, 101-500 and 501+, the net overall gain in drivers in January was 12,988, and in February was 5,918, so we’re still adding real capacity. It’s just coming from different size fleets.

It’s too early to tell if we’re seeing a blip, a small correction, or the beginning of a significant correction and rebalancing of the marketplace. We’re coming into peak season, when produce begins to stir up the spot markets again. If history’s any lesson, a prolonged downturn, or leveling off of spot activity will begin to fill those long-empty seats in the larger fleets’ tractors, as drivers seek steadier income—until the next time.

We must be careful not to discount the new transportation economy. It’s quite different than anything we’ve known. Transportation has taken on new vigor and importance in our consumer economy which demands everything tomorrow, and wants zero inventory. For all the talk of technology and disruptors, it’s the small fleets who are showing strength, staying power and disrupting the plans of the big carrier executives. Smaller fleets are armed with innovative and rapidly evolving tech tools from the major load boards and their broker friends, who are helping them profit in ways they never could in the past. The historic rush of owner-operators “seeking some shelter with the big carriers” may not be as pronounced during the next downturn. It’s anyone’s guess how a market correction shakes out. It’ll be an interesting ride.